Affordability and Foreign Investment - What is the Correlation?

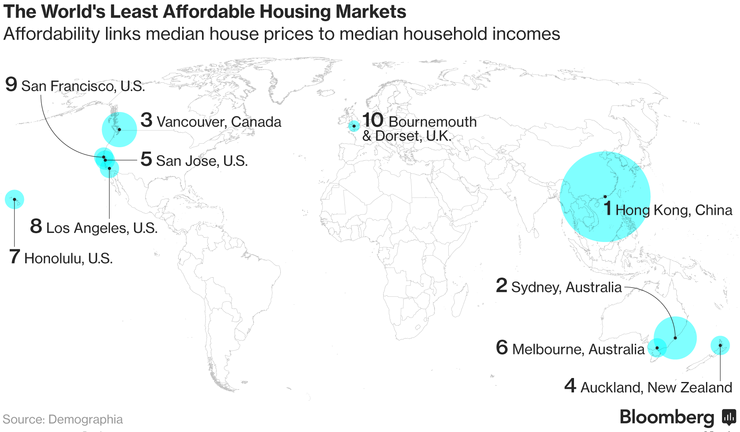

According to Bloomberg, Honolulu, Hawaii is ranked #7 in "The World's Least Affordable Housing Markets". Auckland, New Zealand is ranked #4, and to combat its growing affordability problem the country plans to ban foreigners from buying existing homes. New Zealand does not have extensive data on how many non-resident foreigners buy residential houses. Previous estimates put that number as low as 2% of overall purchases. However its government remains hopeful that the ban on non-citizen purchases will improve chances for young Kiwis to purchase their first home.

The State of Hawaii may not have the authority to ban foreign investors from purchasing property, but that hasn't stopped it from making some recommendations on how to curb it. Housing is so critically limited and the cost of living is so high that Hawaii's population is actually shrinking. On Oahu the 10 year forecasted additional housing demand was estimated at over 25,000 units in 2015 by DBEDT. However, available land and resources for large scale housing developments such as Castle and Cooke's 3,500 home Koa Ridge are dwindling.

The Department of Business, Economic Development and Tourism (DBEDT) conducted An Analysis of Real Property Tax in Hawaii in March 2017. The results of this analysis indicate that residential and related property ownership breaks down as follows:

- 87.5% owned or managed by Hawaii residents or entities

- 10.8% owned or managed by U.S. mainland residents

- 1.1% owned or managed by foreign resident or entities

- 0.6% jointly owned by Hawaii and out-of-state residents

1. Increase residential property tax rate for all home owners and reduce the individual income tax rate

For a $100 million additional property tax revenue, the average effective property tax rate would increase from 0.43% to 0.613% for all the residential property owners (residents and non-residents), Hawaii residents would see a reduction in the state’s effective average income tax rate from 5.25% to 3.88%.

2. Increase residential property tax rate for non-resident home owners only

For a $100 million additional property tax revenue, non-resident home homers would see an increase in effective average property tax rate from 0.83% to 1.21% while Hawaii residents would be indifferent.

3. Increase residential property tax for all home owners and increase resident home owner’s exemption to offset

For a $100 million additional property tax revenue, the exemption amount would need to increase by 75% from the average of $120,989 per owner occupied home in 2016 to $211,730 per owner occupied home.

From the State's perspective, these scenarios would increase tax revenue without hurting Hawaii resident's bottom line. Additionally, increased tax burdens on non-resident owners could:

- De-incentivize non-resident investment in Hawaii residential real estate.

- Make property ownership more affordable for locals.

- Increase rental prices for those renting from foreign investors.

- De-incentivize new residential units from being created using foreign investment funds.

Comments

Post a Comment